The corporate debt bubble: CLOs and company bankruptcies

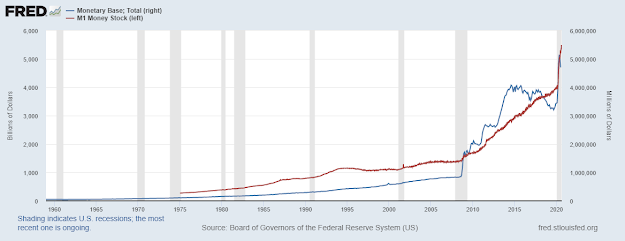

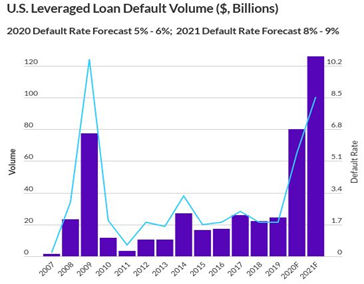

In addition to monetary and fiscal bubbles , another potential issue that could be exacerbated by a prolonged period of low interest rates are rising corporate debt levels of publicly listed nonfinancial companies. Total corporate debt of such companies has already reached historical highs by surpassing $10 trillion in Q1 2020 , and is likely to keep growing in the months to come. Adding to this another 5.5 trillion of corporate debt from SMEs and other non-listed companies the total corporate debt size in the US is now at 73% of GDP . This is still lower than household debt in 2009 which reached almost 100% of GDP, and with lower rates of growth. However, corporate debt will keep on rising – as it did during the 2009 crisis – as a necessary consequence of the pandemic and increasing risk exposure of many companies. Leveraged loan market and CLOs About $1.4 trillion of that market (also at historical highs) is comprised of leveraged loans , which include all loans securitized in someth...