Graph of the week - Remittances

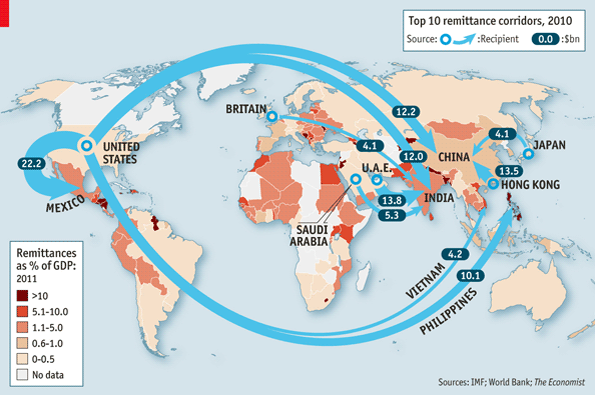

From the Economist comes the following figure on remittances:

|

| Source: The Economist, 28th April 2012 |

Remittances are an interesting economic phenomenon as they can offer a much broader and more precise insight into a nation’s relative wealth and income. They are hardly accounted for when calculating the GDP per capita or national income data, but they do provide significant funding to domestic residents, and they can have a strong positive impact on consumption, and hence aggregate demand in an economy. They could also imply that the relative size of the gap between rich and poor countries in terms of income per capita is lower than perceived. This doesn't imply that it doesn't exist but it paints a different picture for the recipient country's population. Also it can tell us a lot about the recipient country, in particular its institutions.

Countries which have a lot of emigrated workers that send home incomes to their families are usually poorer than countries to which these people emigrate to. The reason for emigration must come from the fact that, on average, in most of these countries people simply can't find work suitable to their qualifications or that the country is stricken with a poverty trap. So the only exit is literally an exit - out of the country. An institutional setting in which incentives that create value are discouraged, sooner or later inclines a lot of people to seek their luck elsewhere. In a majority of these cases they can earn a lot more money abroad than they could ever earn at home (just compare the average monthly earnings in the US, vis-a-vis Mexico). But it's not always about the money either. Countries with the right institutional setting (referred to as 'rich' countries) offer freedom, security and opportunity. This is what in most cases attract people to migrate.

Remittances thus provide a good look into the relative strength of institutions worldwide. It doesn't imply direct causality but can be an excellent proxy for measuring institutional strength. They don't necessarily say much about countries which aren't large remittance recipients however, but they do paint a good picture of remittance recipients.

A simple cross country comparison can illustrate this point - just look at Eastern vs. Western Europe, or Latin America vs. North America. Or certain Asian and African countries. There is a clear divide in remittances recipient status and a clear signal of where institutions work better and where the economic climate is more favourable. Being a remittances net exporter doesn't mean the country has a greater demand for workers - it means that it attracts workers.

Countries which have a lot of emigrated workers that send home incomes to their families are usually poorer than countries to which these people emigrate to. The reason for emigration must come from the fact that, on average, in most of these countries people simply can't find work suitable to their qualifications or that the country is stricken with a poverty trap. So the only exit is literally an exit - out of the country. An institutional setting in which incentives that create value are discouraged, sooner or later inclines a lot of people to seek their luck elsewhere. In a majority of these cases they can earn a lot more money abroad than they could ever earn at home (just compare the average monthly earnings in the US, vis-a-vis Mexico). But it's not always about the money either. Countries with the right institutional setting (referred to as 'rich' countries) offer freedom, security and opportunity. This is what in most cases attract people to migrate.

Remittances thus provide a good look into the relative strength of institutions worldwide. It doesn't imply direct causality but can be an excellent proxy for measuring institutional strength. They don't necessarily say much about countries which aren't large remittance recipients however, but they do paint a good picture of remittance recipients.

A simple cross country comparison can illustrate this point - just look at Eastern vs. Western Europe, or Latin America vs. North America. Or certain Asian and African countries. There is a clear divide in remittances recipient status and a clear signal of where institutions work better and where the economic climate is more favourable. Being a remittances net exporter doesn't mean the country has a greater demand for workers - it means that it attracts workers.

BTW, for anyone with greater interest in the subject, the World Bank keeps an excellent database of remittance net inflows and outflows, by country and even by prices (how much does it cost to send money abroad).

Nice post of showing a circle of transfer money whole in the world. Thank for sharing so helpful article Remittance service

ReplyDelete