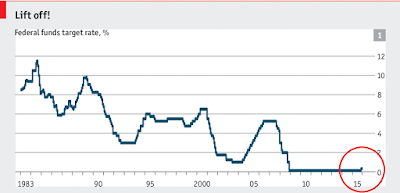

Graph of the year: The Fed increases interest rates!

It has happened. The Fed has raised short-term interest rates for the first time since the start of the financial crisis in 2008. And immediately they've doubled it! The rate went up from 0.25% to 0.5%, with a pledge to be gradually increased further in the years to come. In Janet Yellen's own words: "This marks and end to an extraordinary seven year period."

|

| Source: The Economist |

An increase of interest rates in theory implies several things. Central banks increase interest rates when they want to curb the expansion of the economy, or in other words to prevent its overheating. A quarter of a basis point increase hardly means the US economy is overheating, but in the wake of the liquidity trap during the crisis and the recovery, and particularly Fed's September 2012 announcement that it will purchase mortgage securities as long as it takes until the labor market "improves", this move is viewed as a careful and gradual "return to normal". More importantly, the signal this move sent throughout the world's markets is immense.

First of all, it confirms that the US has fully recovered from the crisis and is now embarking on a steady growth trajectory with unemployment declining consistently for the past 5 years. Even my favorite labor market indicator, the civilian employment-population ratio has improved - it is slowly but steadily rising for the past year and a half. It is still, however, a good 4 basis points below its pre-crisis peak. As I've emphasized a number of times before, this is obviously a new normal for the US (Europe as well - see here and here), as those 4 p.p. of people who lost their jobs during the crisis will probably never return to the labor market.

Second, the signal it sends to markets worldwide is both encouraging and worrying at the same time. In the US an increase of interest rates should imply higher savings since credit is now becoming a bit more expensive (bad for debtors, good for creditors), and more importantly a stronger dollar (higher domestic interest rates appreciate the currency). It should also put a downward pressure on asset prices, as it did but by a small margin. Since the move was well expected throughout the year the domestic markets adjusted easily well before the announcement. The same is true of the dollar - it went up against most currencies today, but this is nothing new. It has been rising steadily against the euro for the past year and a half. By now the USD/EUR exchange rate is likely to actually reach its parity! It's good to hold dollars right now. Especially if you live in the Euro Area.

The dollar growing stronger will inevitably hurt emerging markets. In a 6-year period when US interest rates were at their historic lows, the dollar was gaining strength, primarily because the demand for dollar was increasing. Now as the Fed keeps increasing interest rates (and it surely will already in March 2016), the dollar will only grow stronger. How strong depends on which currency we're comparing it to. Against the euro? Very likely. Against the Rubble? Almost certainly. Against many of the emerging markets' currencies? Also, almost certainly.

Why is this such a big problem for emerging markets? First and foremost since most of their debt is denominated in dollars. The stronger the dollar, the more expensive it is for them to repay their debt. This has all happened once before in the 90-ies, particularly in Latin America. Back then it was called the "original sin" - having dollar-denominated debt backed by local-currency revenues. The weaker your domestic currency (for example because of the lack of demand for newly-printed domestic currency), or the stronger the dollar (or whichever foreign currency the country has borrowed in), the worse it becomes for the country to pay off its debts. In today's slow-paced global recovery, most emerging markets (and most developed economies) are already overburdened with debt. They have trouble meeting payments as it is. A strong dollar coupled with higher interest rates (read: higher borrowing costs) will only make things worse. Believe it or not, the past 6 years were good times for taking on new debt (restructuring it - meaning replacing old expensive debt with new, cheaper one). Now the real troubles will start, particularly as the emerging markets are expecting slower growth next year.

Finally, regarding domestic inflation, the move is welcomed according to most critics. The Fed has announced that this move is the first step to ensure that inflation is contained in the time to come. Throughout the past 6-7 years inflation in the US has been really low, borderline deflation. This is why many inflation doves have claimed that the Fed need not increase interest rates as long as there is no real threat of inflation. However, inflation hawks were saying this is a matter of time, due to the huge amount of money pushed into the US economy over the crisis and recovery period (M1 money stock went from $1,400bn to over $3000bn over only 6 years). The problem is that most of this money has stayed out of the real economy - it has been primarily used to clear banks' balance sheets. Even private sector companies were hoarding cash. But most importantly the real reason why all this money-pumping hasn't resulted in high inflation, neither in the US or in Europe, was because the velocity of money was low. See further explanation here. Anyway, it's a good thing for the Fed to react already to the potential of a price increase. As soon as the velocity of money picks up, there will be an increased pressure on prices. The Fed was smart to anticipate this.

|

| Source: The Economist |

NOTE: The FT has a fantastic, easy-to-understand, coverage of what happens when interest rates rise. I recommend to everyone to take a look.

#FedDecision #fedratehike The Fed interest rate hike has awakened the Force! #TheForceAwakens https://t.co/qAPwbOepCA

— Vuk Vukovic (@im_an_economist) December 17, 2015

So it's only now that they realise that interest rates in the finance world should be adjusted? The bubble is about to burst already and only now is there action… I'm not confident about what's to come at all.

ReplyDelete