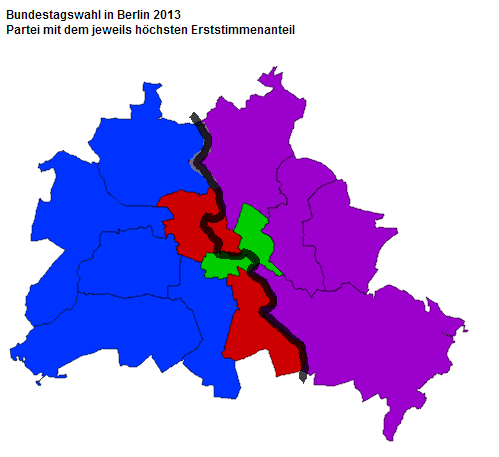

Electoral divisions along the Berlin Wall

Last week's elections in Germany ended up more or less as expected. Angela Merkel's conservative CDU has won by a landslide (42%, only 5 seats short of a full Bundestag majority) ensuring her a third consecutive mandate as German Chancellor (an achievement only reached by two previous Chancellors - Konrad Adenauer and Helmut Kohl). Another expected result was the downfall of her main coalition partner, the liberal democrat FDP, which has fallen short of the 5% threshold to enter the Bundestag. This implies some post-electoral complications as a grand coalition between CDU and SPD (the social democrats) is inevitable. This was the governing coalition during Mekrel's first term as Chancellor and it was because of the coalition that the social democrats were punished in their subsequent elections. Just like what happened with the FDP in fact. Anyway, with the victory Merkel has further strengthened her position as Europe's undisputed leader, which is undoubtedly good...