The politics of bailouts: How political connections of banks conditioned their bailout during the financial crisis

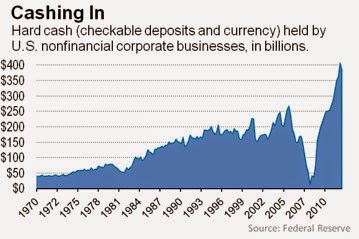

My new paper (open access; meaning free to read) is out in the new edition of Public Choice (published online first in February this year). This was my second PhD paper at Oxford, and one I am particularly fond of given the importance of the topic and one of the cornerstone arguments of my upcoming book Elite Networks: The Political Economy of Inequality (more on that below). What's the main finding? In short, I looked at the effect of political connections on the allocation of TARP funds to US banks, and found that TARP recipients that lobbied the government, donated to campaigns, or whose top execs had direct connections to politics received better bailout deals. Let’s unpack this. In 2008, as the crisis unfolded in the US, the banking industry elevated its lobbying and campaign spending activities. You might remember the panic days in Sep & Oct ’08 where it seemed like the financial world is collapsing. Getting bailed out was a priority for many banks, es...