Monetary and fiscal bubbles after COVID

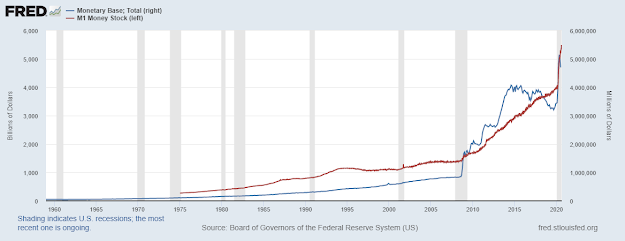

In the previous blog I analyzed the stunning divergence between the markets and the real economy. I emphasized three particular reasons for why this is happening: (1) huge monetary and fiscal stimuli that started the V-shaped rebound on the markets in March; (2) exuberant (and by all means irrational) expectations driven primarily by the so-called retail investors (the subject of one of my next blogs), and (3) the asymmetry between firms driving the market (the top 5 big tech firms) vs the unlisted SMEs laying people off and declaring bankruptcies. In this blog I will touch upon the potential instabilities of the first effect: the monetary and fiscal stimuli. While the stimuli were designed to calm the market panic back in March, its continuation - particularly from the Fed - is creating massive instabilities elsewhere. Specifically, there is ample evidence of a growing monetary bubble , unavoidable fiscal instabilities due to rising debts and deficits, and even a potentia...