The corporate debt bubble: CLOs and company bankruptcies

In addition to monetary and fiscal bubbles, another potential issue that could be exacerbated by a prolonged period of low interest rates are rising corporate debt levels of publicly listed nonfinancial companies. Total corporate debt of such companies has already reached historical highs by surpassing $10 trillion in Q1 2020, and is likely to keep growing in the months to come. Adding to this another 5.5 trillion of corporate debt from SMEs and other non-listed companies the total corporate debt size in the US is now at 73% of GDP. This is still lower than household debt in 2009 which reached almost 100% of GDP, and with lower rates of growth. However, corporate debt will keep on rising – as it did during the 2009 crisis – as a necessary consequence of the pandemic and increasing risk exposure of many companies.

Leveraged loan market and CLOs

About $1.4 trillion of that market (also at historical highs) is comprised of leveraged loans, which include all loans securitized in something called collateralized loan obligations (CLOs).

Similar to their namesake counterpart, collateralized debt obligations (CDOs), CLOs are financial derivatives constructed of corporate loans given to companies with low credit ratings. These are typically companies which cannot qualify for a traditional bank loan (like start-ups or companies which have not yet started making significant revenues out of their business model), or companies which are already too overborrowed and cannot sell their bonds directly to investors.

For these companies this is helpful as it gives them alternative access to capital. Problem is that some of them use the money from such loans to buy back stocks or pay out dividends, thus presenting a better image of themselves to their shareholders. The obvious negative consequence is piling up more and more corporate debt, making such loans even more risky and with a greater probability of default.

All this is creating a systemic imbalance in the economy. If companies are using debt to buy back their stocks, or are simply exploiting the low interest rate environment, an economic downturn could severely impact their earnings. This will make it even more difficult to service those debts which would significantly increase the threat of bankruptcy, and by extension increase the risks for banks.

|

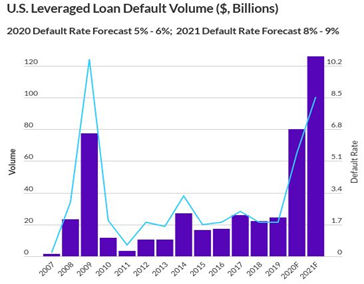

| Expected leveraged loan defaults according to Fitch. |

Risk sources in the leveraged loans market

There are several sources of risk for banks in the leveraged loans market. Frist there is exposure to revolving credit facilities and warehouse facilities – short-term funding for firms with liquidity problems – of around $780 billion. Second there is exposure through the arrangement of syndicated loans where banks are at risk of keeping more shares than they wanted through pipeline exposure if investors for some reason do not pursue with investment as agreed. US banks have an exposure of around US$65 billion through this mechanism. Finally, there is exposure through third party CLOs, the market for which is over $700 billion (3.27% of GDP), where the cumulative losses of the top three US banks would be around $40 billion in the worst-case scenario of massive corporate bankruptcies.

Altogether all these sources of increased risk for banks from exposure to leveraged loans represent around 60% of common equity tier 1 capital for 59 US banks, which is a considerably large exposure.

The biggest defaults on leveraged loans are expected in sectors with highest sensitivity to the pandemic: energy, non-food retail, restaurants, travel/leisure. Total volume of high-risk sectors accounts for approximately $225 billion or 16% of the leveraged loans market. By the end of 2021 defaults could go up to $200 billion, while defaults of leveraged loans will top $80 billion in 2020 and $120 billion in 2021 which is in both cases higher than the previous record of $78 billion defaults in 2009, however the default rate is projected to be slightly below the 10.2% in 2009 (as shown in the figure below). Higher expected defaults of such loans could destabilize banks holding large volumes of CLOs.

|

| Distribution of US corporate debt by rating category. Source: Fitch. |

Investment grade bond issuance and holders

In the overall corporate debt market about $8 trillion are corporate bonds. The majority (72%) of rated corporate bonds in the US are investment grade (>BB). That being said, and the fact that so far in 2020 issuance of investment grade corporate debt has reached $1 trillion, a closer attention needs to be payed to the investment grade itself.

The majority, around 54%, of investment grade debt is rated BBB or Baa (Moody’s) and it is clear to see how the number of issuers is disproportionally lower in comparison to the amount issued (see figure above). This implies higher risk of defaulting because amounts borrowed are concentrated between a smaller number of borrowers. If BBB rated debt gets downgraded (and as of June 20th 20% of BBB is on negative outlook in comparison to 6% at the beginning of the year), it automatically becomes “junk”. These downgraded bonds alone have added $88 billion of supply to the high-yield bond market so far this year. This is particularly important in the current pandemic where a company’s ability to return the borrowed money becomes less probable and a downgrade in ratings becomes a possibility.

According to the Financial Stability Board (FSB), a worsening of the macroeconomic scenario could lead to a higher rate of downgrades, particularly of highly leveraged corporates, and more defaults. Analysis suggests that bonds issued by highly leveraged corporations are not necessarily downgraded during times of good economic growth but are downgraded more frequently once macroeconomic conditions deteriorate. Historical data also show a correlation between the level of corporate leverage and downgrades since both increase during periods of economic downturns.

Given that this debt is being used as a tool for refinancing, M&As, and leveraged buyouts (especially in March, April and May 2020), which does not necessarily lead to a prosperous future of the company, pilling up debt in still uncertain times of COVID-19 is not a sound business strategy.

Furthermore, structurally higher non-financial corporate leverage has a procyclical effect on debt and equity prices of publicly listed corporates and, as such, can amplify financial market shocks. In other words, companies increasing leverage now as a consequence of the COVID pandemic, are becoming even more vulnerable and increasing their risks of bankruptcy.

Historically, investment-grade bonds witness a low default rate compared to non-investment grade bonds. However, if the downgrades persist certain holders like life insurances, where the industry has increased its exposure in this class by about 75% over the past 10 years, could be urged to boost their capital buffers because the risk-weighted ratio would be changed.

In the last two years US insurers had about 30% of their total bond exposure invested in BBB corporate bonds. As of May 2020, top five mutual funds had at least 68% of their investments in investment grade corporate bonds. Pension funds decreased their involvement in fixed income but their investments in corporate bonds seem to account for about 15% of total investments on average. According to a Blackrock report, almost 54% of BBB corporate bonds mature in or after 2026, while only a little over 3% of BBB bonds are set to mature in 2020 which reduces refinancing risk.

Expecting downgrades, bankruptcies, and deleveraging

In conclusion, the US leveraged loans market will almost certainly continue to grow. The biggest holders of those loans have stable protective buffers, while the amounts invested in leveraged loans in relative terms (in comparison to total assets) are not considered as a major default threat yet.

On the other hand, the recent growth of BBB-rated corporate bonds poses much more concern. The majority of corporate debt invested in BBB-rated debt is by its structure one step away from getting downgraded to “junk” status which could then cause a chain reaction of investors selling those bonds, followed by a further bond price deterioration and overall financial instability. A downgrade does not immediately imply default but non-investment grade debt historically had bigger chances of defaulting. Furthermore, the systemic downturn also depends on investors’ willingness to hold downgraded bonds and on other investors taking advantage and buying recently downgraded bonds.

The situation and predictions in the corporate bond market change on a weekly basis as more bonds get downgraded, more companies default and the COVID-19 uncertainties are still present. Therefore, to be able to make clearer conclusions, the reevaluations and analyses of the corporate bond market need to be followed constantly in the next few months.

One thing is certain, with such huge debt levels one can expect large deleveraging from the private sector, which is likely to mirror potential austerity measures of governments in the years to come.

Comments

Post a Comment