Political economy of debts and deficits (2): Theoretical overview

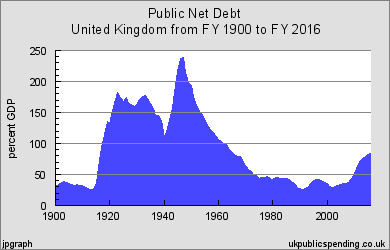

After a brief intermission it's time to continue with the PE of debts and deficits . In today's post I will present a theoretical overview focusing on the common-pool problem and political instability. According to Persson and Tabellini (2000) high debt and deficit levels appear to be correlated with specific political and institutional features: high debts are characteristics of countries ruled by either coalition or unstable governments. This seems to suggest that institutional factors as well as political factors play an important role in public debt policy. They present a detailed overview of the political economy models of public debts[1]. They survey the literature and present two main types of models explaining the problem of deficits and debt in an economy, from which I will in the following blog post derive the main hypotheses explaining the rising debt levels since the 1970s onward . Source Common-pool problem They focus first on the effects of intere...