Achieving political stability – is it possible?

As an advocate of political stability as the crucial starting point which can address the radical dependency problems in Greece and most of Europe, I find it frightening how hard it is to achieve this stability, particularly when the political situation and the currently prevalent opinion among Europe’s citizens is turning more and more radical.

The latest article from an excellent political economist commentator Protesilaos Stavrou illustrates this point for the current political lock-down in Greece. The level of ideological heterogeneity that developed in the Greek society during the sovereign debt crisis is astonishing. From right-wing nationalists and neo-nazis, to radical socialists and communists - it seems that every option apart from a liberal one has entered parliament in the May elections. Naturally, the inability to form a government was the only possible outcome. Protesilaos describes the micro-political factors behind the inability to consolidate and points out to four probable scenarios that could happen as a consequence of this ideological outcome, none of which seems to offer much hope to the country. The move towards ideological radicalization is threatening to become too strong for any attempt of long-run institutional reform. Tired from all the pushing around it is no surprise that people are becoming more and more guided by emotions, instead of reason. Hatred towards the whole European project is reaching unprecedented levels. On the other hand, neither domestic or foreign politicians are doing anything to prevent this. On the contrary.

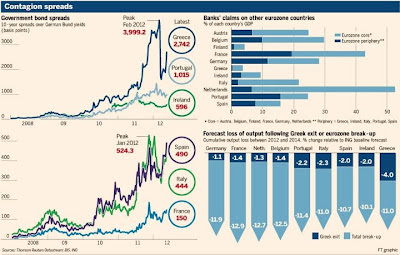

Similar issues of radicalization and the feeling of hopelessness are emerging throughout Europe. I already warned of the threat of nationalism in Hungary under Orban, but it seems this threat has spread across much of the Eastern Europe. Not only is the economy in dire straits (again - see figure), but many states are faced with a political system close to collapse as well.

|

| Source: Financial Times, 18th May 2012. |

It is understandable why this is so. People are fed up with incompetency of current governments to deal with the crisis. On the other hand governments are unwilling to move forward any radical reforms that could address the systemic issues in Europe. This status quo situation is ruining confidence and increasing uncertainty. It is undermining political stability as well since the further this situation continues, the worse will be the reaction of the people and hence the final outcome. Greece is unfortunately a case in point.

So in order to achieve political stability and prevent radicalization, the proper response has to be pan-European and arrive via an international agenda. An international agenda focused on institutional reforms based on a new underlying theoretical and analytic framework, much different from austerity measures focused only on deficit and debt reductions. Only an international agenda will possess a substantial amount of negotiating power that could encourage a change in the dependency mentality. By this I don't mean that Germany et al should engineer the reforms, but rather a consensus to an approach based on scientific rigour that emphasizes the long-run importance of institutional reforms.

Even if we imagine (for a second) that such a nation-wide consensus is possible, this approach will still be very hard to implement, since it requires a change in political culture and most of all, a change in mentality. No national politician will be willing to engage into this sort of reforms, nor will the voters be open to outside enforcement of new rules. As much as it is desperately needed, it is so much harder and delicate to implement.

And so the quest continues. The currently attractive option are eurobonds, briliantly debunked today by ASIs Eamonn Butler, saying "Just because you want to ignore economics does not mean that economics will ignore you." But there are other options as well, fortunately none of them based on devaluation of currencies, large fiscal stimuli, inflation or similar ideas. Protesilaos has pointed me to the direction of two economists, Yanis Varoufakis and Stuart Holland who

came up with a "Modest Proposal" to resolve the crisis. It focuses on three policies: creating a single banking authority and regulator, debt conversion via the ECB, but not requiring monetization of the debt thereby reducing the threat of inflation, and promoting an investment-led recovery afterwards. It's basically a call for federalism of the financial sector without sacrificing political goals. This week's issue of the Economist advocates a very similar approach.

I’m sure there are many economists out there with even better and more innovative approaches on how to resolve this and, above all, how to achieve political stability that will have the necessary strength to engage into reforms. Unfortunately, their voices are unheard, primarily because of the dominance of those advocating quick fixes that are much more approachable and acceptable to politicians. Naturally, short-termists will always look good in the eyes of politicians and in the eyes of the media and their median reader. But the median reader, just like the median voter, will seldom realize the grave dangers in these kind of approaches. For example, no one could have foreseen at the time that having the Greek and German governments being able to borrow at the same costs, with two very different approaches to fiscal policy, was a terrible idea that would partially cause the contagion Europe is currently in.

The biasness and the persistent fallacies over what is the ‘right way’ – austerity or stimulus, austerity or growth, monetary action from the ECB etc. – have to be overcame by a theoretical and empirical framework that can be applicable to policy. The several ideas called upon in this article can provide a step closer to resolving this, but an international policy approach must be consistent with it. They've tried almost everything else – and have failed. Perhaps it's time to try something different, something real and something long-term oriented.

It's hard to reach stability when there is so much negativity surrounding the european project. People are losing hope and so are investors. That's why the borrowing costs are still staying up despite all the efforts to consolidate public finances. I'm afraid there isn't much left but a gradual separation of the south, and formation of a strong union in the north-west. It will bring forward much turmoil but there's a chance to start over for Europe. It's better than what we have now.

ReplyDeleteI can't say I agree with you there Charlie, since a euro break-up and separation certainly wouldn't be better than what we have now, no matter how uncertain things get. The separation of Europe would lead to first rising protectionism and then rising nationalism. It would in one go destroy everything that was being built in the last 60 years. Every positive effect of the EU would be reversed and there would only be a question of time before the tension between the separated parts of which you speak would engage in war against one anohter.

DeleteThis is why political stability is important, as Vuk claims. And this is why I support any idea that would lead to the preservation of political stability, not disruption.

btw, the so called Modest Proposal is not a bad idea, from what I read so far.

I agree with Mike, a collapse would be the last thing we need.

DeleteYou and Mike may be right but I doubt that it would lead to any sort of warfare, at least not for generations. Rather than fighting a war, the European states (especially western Europe) will be hard pressed just to stay solvent and viable.

DeleteThe people of Europe are of a certain mindset that will not attempt anything which may require actual hardship or effort.

"The people of Europe are of a certain mindset that will not attempt anything which may require actual hardship or effort." - excellent point!

DeleteAnd yes the war does seem like a distant scenario, although a collapse would in my opinion be a disaster due to rising protectionism and nationalism that would endanger the whole European idea.