The LIBOR scandal

London’s financial markets have been disrupted severely in the past few weeks. The LIBOR scandal revealed a striking image of how the financial system worked and how it was interrelated with the political and the regulatory environment. The signals were being disrupted from a whole number of sources.

The LIBOR is the London Inter-Bank Offered Rate, which basically means the rate at which banks are willing to lend money to each other. It is a benchmark rate used for a number of transactions and financial instruments, ranging from mortgages to derivatives, thereby affecting the prices of loans. Its total breach on the market is an estimated $800 trillion-worth of financial instruments. The whole process of setting up the LIBOR rate is that each bank sends its own estimate of the rate to the British Bankers’ Association (BBA), an independent body which then creates the benchmark weighted rate by cutting off the top and bottom 25% of the individual submissions. It operates on an auction principle meaning that banks submit a rate they would pay to borrow, with respect to current market conditions.

Financial cartel

The problem with this was a formation of a cartel of traders (so far the blame is on individual traders, not the Chief Executives who claimed to have not known of what low-level traders were doing, but nonetheless resigned as a consequence of the affair). Even though an auction sounds like a perfectly fair and reasonable way of setting the rate, it can well be exploited within a “bidding ring”, a type of a cartel where bidders align with each other to manipulate the final offer rate, biasing it downwards. They were able to do this and correspond with each other since the BBA made individual estimates public, as a call for greater transparency of the process.

David Henderson points out to why greater transparency in this case might paradoxically lead to formation of a cartel:

"...[making transactions publicly available] would facilitate collusion and cartels. One of the biggest barriers to collusion is that the members of the cartel can't know if their fellow members are cheating on collusive agreements. The cartel members can agree to share information about prices, but just as they have an incentive to cheat by cutting prices a little, so also they have an incentive to cheat by misreporting prices. And it is that incentive to cheat that protects us consumers... [If the government would] enforce accurate reporting, and back it up with fines, and now the information that the companies report will be more accurate. Result: collusive agreements are easier to enforce."

The Economist notices the same problem, and proposes a swift solution:

"In Mr Klemperer’s “product mix” auction, bidders submit detailed bids, which include both the prices they would pay and quantities they would accept for a range of goods. Because bids are simultaneous and are never revealed, bidders cannot learn from one another, making collusion harder. Since the auctions are of the many-winner financial type, a knockout system, as in the stamp bidding ring, is unlikely.

"Having received a set of bids for different goods, at various prices and quantities, the auctioneer in Mr Klemperer’s set-up then conducts a proxy auction on bidders’ behalf to see who should get what, and what the price should be. Because nothing is revealed to the bidders and they know they cannot influence this process, their best bet is to tell the truth. What is more, since the auctioneer has price information for a range of quantities, it is possible to see how prices change as supply does."

The scandal

It is natural to assume why banks would want to rig the rate downwards – it lowers their borrowing costs and makes them better off. As a result, Barclays, the only bank so far officially accused of rigging the LIBOR, had to pay a fine of $450m. They were charged of rigging the LIBOR in two periods, from 2005 to 2007, and more recently during the start of the financial crisis in 2008. Top three chief executives in the bank resigned within a week of the scandal going public, including the CEO and celebrity among bankers, Bob Diamond. However, other banks were included as well and are under further scrutiny. This includes JPMorgan Chase, Citi, UBS, Deutsche Bank and HSBC. The former was even linked to money laundering and dealing with terrorists, criminals and drug cartels. The investigation is currently ongoing in the United States.

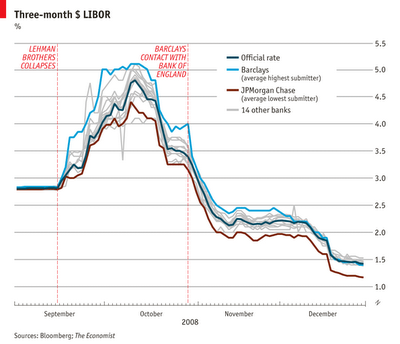

However, in my opinion, the crucial issue weren’t the decreases of the rate in 2008 to which Bob Diamond testified in front of the Treasury Select Committee in the UK (a committee made up of UK Members of Parliament). This can actually be justified as Barclays was being afraid of a government bailout (which is what Diamond said in his testimony) so it needed to prove that it was solvent and liquid enough. Having a high LIBOR submission was a sign of weakness which could have led to deals falling through. Barclays was constantly the highest submitter (see graph), which is why some of the politicians got worried. They had a lot of ongoing deals that would all be under serious threat if the government had to bailout the bank. It would undermine Barclays' credibility. There was evidence that the regulators (the Bank of England) and the government expressed serious concern that the Barclays submitted rate was too high and will it need a bailout. So the main reason to lower their LIBOR submissions was to ease the political pressure on the bank.

|

| Source: The Economist, July 5th 2012. "As the chart shows, after Lehman Brothers collapsed in 2008, Barclays' numbers were among the highest. Indeed, the bank has admitted to asking traders to keep its numbers in the top four (and so be discarded), but not high enough to draw attention to it. But a complicating factor is whether Barclays thought it had the tacit support of regulators and the Bank of England. Notes taken by Bob Diamond, then head of investment banking, of a phone call from Paul Tucker, a senior official at the central bank, appear to have been interpreted by some at Barclays as a nudge and wink to fudge the numbers. Its submissions fell the following day" |

But even if we somehow justify this by adverse conditions the bank found itself in at the time, what is completely unjustifiable is the rigging of the rate from 2005-2007.

Naturally, all of this once again increased the public anger on the bankers. As if their credibility wasn’t low enough. Once again, the questions of ethics, principles and banking culture are being raised in the public. They want to see heads falling. Three of them had already fallen. All three chief executives of Barclays have resigned as the consequence of the scandal. The question is, why didn’t they know of the rate rigging before the crisis.

What must be done?

First of all, a witch hunt on bankers would be counterproductive. "Rather than focus on the people involved or expect bank executives to morph into Mother Theresa, we should instead direct our attention to fixing the institutional framework" (Joffe: "Libor and transparency", July 3rd). As with the case of a majority of countries and sectors, banking as well is in need of a serious reform. It’s not just the culture of banking – it’s everything.

The biggest reason why some rogue traders behaved that way was because they were allowed to do so without any consequence. When no one punishes a person for doing a criminal act, he or she is encouraged to continue doing so. No one punished traders that rigged rates (Diamond’s testimony led us to believe that the senior management had no idea what its investment bankers were doing). A clear, strong signal that this sort of behaviour is unacceptable anymore would be to immediately find out who the rogue traders were and imprison them. Firing the Chief Executives just isn't enough. When bankers finally realize they cannot get away with this anymore, the culture might start to change.

The reason this happened can somewhat be traced to deregulation, i.e. regulators not being fierce enough to punish this behaviour. But more importantly this behaviour is an example of crony capitalism, where bankers could use their money, power, and influence to release any pressure off them. This gave them the confidence that they can get away with anything. Reforming this culture or 'mentality' requires a strong rule of law that appears to be diminishing in the forefronts of capitalism – United States and Britain (at least in the financial industry and politics). The problem starts and ends with institutional failure which sends signals to bankers that they can behave as they wish, while no one will stand against them, primarily because it was in no ones interest to do so.

As for the LIBOR itself, I agree with the aforementioned point made by the Economist on changing the auction style and on their further points how the rate should be based on actual, not estimated borrowing costs. However, I also find David Henderson's solution quite appealing:

The market failure of imperfect information and adverse selection is best solved by the market itself."So what's my solution? The publicity that has occurred about LIBOR is part of it. To the extent that the word gets out that LIBOR is not an honest or accurate estimate of average interest rates, people will demand honesty or find alternative measures that are more accurate.When I advocate free markets, I don't do so with the idea that no one in markets will make mistakes or that no one will cheat. Many people will make mistakes and many people will cheat, especially with new financial vehicles. But what the market offers as a solution, which government regulation doesn't do as well at, is that when people find out about it, they can act on the information."

Another potential area of reform is the bonus culture. When traders submitted lower LIBOR rates in pre-crisis times this reflected on the banks performance, and thus on the traders’ performances. The more money you make for the bank, the more money you make for yourself. Sounds like a perfectly fair deal, except when driving the bank’s performance requires you start doing illegal things. That's why I wouldn't call them rogue traders, but simply extra-profit motivated individuals!

ReplyDeleteThe way I see it they should only receive their wage for doing their jobs, nothing more, nothing less.. The incentives for extra-profits not only drove high risk, but apparently even led to criminal activities..

Good text, BTW!

Thanks!

DeleteAs for the bonus culture, I agree it needs to be reformed, but one should be careful in how to do this. I wrote a text about this a few months ago (see here), so I will refer you to it (even though I see you already read it and commented on it). My point from the end of the text is something I still strongly believe in:

"The finance industry is not the enemy. It is the crucial line of support for the real sector, and the more diverse and developed it is, the better it is for the economic growth of a country. However, competition must be restored in the finance industry. My worries aren’t based on big performance bonuses, short-term or long-term; rather I’m more worried about the problem of oligopoly in banking which is currently keeping high prices on lending for small businesses. In addition, a lack of competition will do what every monopoly or oligopoly tends to do – lead to a big distortion of prices in the market. This was the problem in the first place, along with misguiding regulation that led to the downturn in the market. Big bonuses just exacerbated the public anger."

Isn't Barclays the bank that lost billions in the Asian markets about ten years ago, or am I thinking of another British bank?

ReplyDeleteNot really sure...You probably mean the loss they inquired from the Russian debt default in 1998? Diamond was at the time the head of BarCap, and he offered his resignation, but the fromer CEO didn't accept it. (I found this out only recently due to the unfolding of the whole Barclays story)

Delete