Tracking the recovery (2) – business and consumer confidence

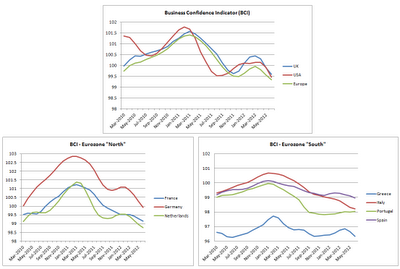

Continuing with the Recovery Tracking series after a brief graph of the week pause, we look at business and consumer confidence in the US, UK and Eurozone, comparing them to the situation from 6 months ago. The OECD once again offers a good database of tracking these indicators, in particular the Business Confidence Indicator (BCI) and the Consumer Confidence Indicator (CCI).

Business confidence

|

| Source: OECD Standardized Confidence Indicators. Latest data available for June 2012. Click on graph to enlarge. |

I've limited the data to start from May 2010 to focus only on the recent shock in confidence experienced in 2011. Looking at the US and the UK in the first graph, a shy recovery from January onwards was soon brought to an abrupt end around April. This is something that the leading indicators failed to take account of. The reason is the faster reaction rate of business (and consumer) confidence indicators to a series of bad news that surrounds the business-owners.

And while the US and the UK saw the first quarter of 2012 as a move in a positive direction that was soon interrupted, the European periphery (lower right graph) experienced no such thing. Even in France, Germany or the Netherlands, the increase of confidence was only half a basis point. In the end, the brief increase of business confidence in the first few months of 2012 was soon interrupted by signals sent from the periphery. And again, as the European LEI showed previously, we are back to where we were in December. One ECB push was enough for only a few months. Good thing Draghi just announced another one. We'll see where this will take us.

And while the US and the UK saw the first quarter of 2012 as a move in a positive direction that was soon interrupted, the European periphery (lower right graph) experienced no such thing. Even in France, Germany or the Netherlands, the increase of confidence was only half a basis point. In the end, the brief increase of business confidence in the first few months of 2012 was soon interrupted by signals sent from the periphery. And again, as the European LEI showed previously, we are back to where we were in December. One ECB push was enough for only a few months. Good thing Draghi just announced another one. We'll see where this will take us.

Consumer confidence

|

| Source: OECD Standardized Confidence Indicators. Latest data available for June 2012. Click on graph to enlarge. |

Consumer confidence was much shier than business confidence. Neither European nor the UK consumers were showing any signs of optimism. US consumers apparently did until May, but this has recently also started to descend down a declining path. As for the rest of Europe, the increase of optimism in France and Greece can best be explained by their elections where the people saw new hope of upcoming political solutions. If you compare this to the business confidence at the same period you can notice an inverse trend. It seems that the election uncertainty was bad for business but good for the people. However, the outcome of the elections so far wasn't beneficial to either of the two groups.

In comparison to the situation from 6 months ago, the conclusion is similar to the previous two posts. Things are back to where they were, with 6 more months spent on not reforming and scraping through with half-baked solutions. This only made things worse for governments and its voters. Instead of following positive examples of reforms, Europe collectively descended into maintaining the status quo, hoping that the ECB will somehow step in and save the day. That's what everyone is putting their money on at the moment. It will be interesting to see what will happen in the second half of 2012 as a response to this reverse of fortunes. Last year around this time troubles re-emerged. Let's just hope this time such a scenario will be prevented, since neither Europe nor the US have the strength to bear that again.

Update (15/08): The Gallup pool shows a US nationwide drop in economic confidence (tracking from January to June), however, they notice an improvement of confidence from 2011 to 2012, which can be interpreted as positive news. An interesting detail is that Washington DC is the only state showing a strong increase in economic confidence in the first half of 2012. Maybe they really are living in their own world.

In comparison to the situation from 6 months ago, the conclusion is similar to the previous two posts. Things are back to where they were, with 6 more months spent on not reforming and scraping through with half-baked solutions. This only made things worse for governments and its voters. Instead of following positive examples of reforms, Europe collectively descended into maintaining the status quo, hoping that the ECB will somehow step in and save the day. That's what everyone is putting their money on at the moment. It will be interesting to see what will happen in the second half of 2012 as a response to this reverse of fortunes. Last year around this time troubles re-emerged. Let's just hope this time such a scenario will be prevented, since neither Europe nor the US have the strength to bear that again.

Update (15/08): The Gallup pool shows a US nationwide drop in economic confidence (tracking from January to June), however, they notice an improvement of confidence from 2011 to 2012, which can be interpreted as positive news. An interesting detail is that Washington DC is the only state showing a strong increase in economic confidence in the first half of 2012. Maybe they really are living in their own world.

This confidence curve seems to also track the stock market fairly well. Up in the first quarter then down and stagnant.

ReplyDeletetrue and it makes sense when you think about it. More optimism in the stock markets brings about more optimisim among businesses and consumers. The argument can also be applied vice versa..

Delete