The Baltic lessons

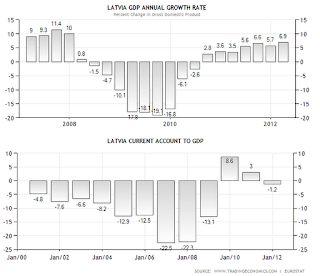

The monthly cross-country overview continues with examples from the Baltic and their lessons for Europe and its endless recovery.

|

| Source: Trading Economics |

But they all underwent different recovery paths, some more successful (the Baltic countries), some less (Iceland), and some outright terrible (PIIGS). And while Iceland’s recovery was based on depreciation of its currency, letting the banks default and export-led growth supported by a stronger institutional environment than in the rest of Europe, the recovery of Latvia appears to be a much more sustainable path (even though it didn't seem like it 2 years ago), especially applicable to countries with similar conditions (like Greece, Hungary, Croatia or any number of Eastern European countries).

It didn't start well at all for Latvia. If you see the graph above, after their adjustment started, GDP plummeted in 2010. It was painful. Unemployment surged, people emigrated massively and capital flew from the country. However, the peg remained fixed, and Latvia avoided the Argentine scenario (hint: Corralito).

And here’s why it needed to stay fixed (with even Blanchard being rather sceptical at this strategy at first):

"The treatment seemed straightforward: a sharp nominal depreciation, together with a steady fiscal consolidation. The Latvian government however, wanted to keep its currency peg, partly because of a commitment to eventually enter the euro, partly because of the fear of immediate balance sheet effects of devaluation on domestic loans, 90% of them denominated in euros. And it believed that credibility required strong frontloading of the fiscal adjustment." Blanchard, "Lessons from Latvia", June 11th 2012

So, depreciation was not an option due to serious problems it might have caused to all those with loans outstanding in foreign currency. As I've emphasized before, the same effect would have caught Greece if it suddenly returns to the Drachma. Croatia has the same euro-denominated monetary system. With countries like Latvia or Croatia, maintaining a fixed peg is a must, or else financial stability is seriously threatened.

Blanchard further stresses why this strategy has succeeded, amid the initial difficulties:

"1. The adjustment was preceded by an unusually strong boom, so there was wide acceptance on the part of people that part of the downward adjustment was a return to normal....

2. There was support for fiscal consolidation, and the acceptance of pain. Parties which argue for stronger fiscal austerity often did better than the others at the polls....historical reasons, including the painful transition from central planning in the 1990s, surely played an important role. The Latvians could take the pain.

(I think we already established that the Greeks and other peripheral nations can take the pain - they've put up with it for 5 years now, and due to the incompetence of their leaders to deliver the necessary reforms, it looks like they will have to put up with it even longer - unfortunately)

3. Wages were flexible, at least relative to the generic European labor market. The initial adjustment came with a dramatic reduction in public sector wages, and thus a direct improvement in the fiscal position. Together with unemployment, lower public sector wages put pressure on private sector wages to adjust...however...private sector wages, which are the wages which matter for competitiveness, have adjusted much less than public sector wages. Indeed, I worry that nominal wages have started to increase, while more adjustment still has to come to maintain current account balance as output recovers.

4. There was...substantial room for productivity increases. Latvia has income per capita of half the European Union average. Being far behind the technology frontier, it has a lot of room for catch up.(Again, both applicable to PIIGS)

5. Latvia is a small, open economy—although less so than its Baltic neighbors. With exports around 50% of GDP, improvements in competitiveness can have large effects on both imports and exports, and in turn on GDP.

6. Public debt was very low to start, less than 10% of GDP. Even today, public debt remains around 40% of GDP. This more or less eliminated foreign investors’ worries about default on sovereign debt, and allowed for a quicker return of Latvia to international financial markets.

(Ok, so this is the only advantage Latvia had over the PIIGS. But I doubt it's a crucial difference, as reforms and willingness to adjust make investors more optimistic on the final outcome - besides, every one of the PIIGS had a much better starting point in the eyes of foreign investors than Latvia ever did, despite its low debts).

7. The Latvian financial system was largely composed of relatively friendly foreign banks...or friendly but weak domestic banks... the Swedish banks recapitalized their banks and maintained their credit lines to the Latvian subsidiaries, reducing the intensity of the sudden stop and of the credit squeeze." Blanchard, "Lessons from Latvia", June 11th 2012

(I find this argument rather confusing, mainly due to the interpretation of the word "friendly" - Swedish banks weren't "friendly" to Latvia - they were "friendly" to themselves in order to prevent massive losses - something German or French banks failed to do so effectively).

Turning to Estonia

|

| Source: Trading Economics |

Another similar success story that gained even more attention in Western media was Estonia. It was equally struck by the crisis as Latvia, with and equally impressive pre-crisis growth funded on a large CA deficit. Once the crisis hit, things went down pretty bad - rapid fall in output, massive rise in unemployment (almost similar to Latvia - from 4% to 20.1%), stock market slump, capital flights, etc. And the response - austerity - all the way! They started with the labour market; slashing public sector wages, raising the retirement age, reducing job protection - all painful reforms which led to more job losses initially, but in the end all necessary to address the competitiveness issue. The second step was on businesses. Reducing and simplifying taxes, removing regulatory burdens, creating a favorable business environment - these are the sort of things that will attract foreign investors, not ECB cash. Innovation, start-ups and technology were at the center of their recovery. In the end, Estonia even joined the euro on 1st Jan 2011 - so, again, no external devaluation, no easy short-term solution, but rather internal devaluation, painful in the short run, but much better in the long run. And for those saying that in the long run we're all dead - well, Estonia has already reached it's long run, and is quite enjoying it.

Critics say that this was too drastic. But isn't the 5 year torture of peripheral Eurozone drastic as well? Which is more moral in these cases? To suffer for two years like Latvia, Estonia or Iceland or to suffer for 5 years without any positive sign on the horizon for the upcoming 5 years either?

Finally, in comparing the cases of both Latvia and Estonia with Iceland or Argentina, one can once again see that currency depreciation isn't always the solution. And from the looks of it, Estonia and Latvia picked a much better path to recovery - no one ever said it would be easy, but it sure doesn't have to last long. Europe, take note.

That's a good story of how Latvia and Estonia withheld the pressure, but there is a different side to it.

ReplyDeleteTheir people seem to be more resilient to painful adjustments, as they already experienced one in their lifetime, some 20 years ago when they transitioned from communism.

It does amount to, in the end, how the people will take it. As Blanchard said, the pro-austerity parties did better in the polls.

People realized something was needed to be done, and instead or resisting change, they embraced it.

I think this can explain a whole deal why the rest of Europe lags in their recovery.

It can explain to some extent, but the reason why people are becoming less and less ready to embrace more real austerity measures is that this status quo situation is going on for 5 years now.

DeleteNothing is changing and it seems to be getting worse on a daily basis. Naturally levels of confidence in politicians are at historical lows, but the politicians have only themselves to blame. How can anyone come to the Greeks, Italians or Spaniards and tell them there's 5 more years of the same or even worse ahead? No one has the courage to say it, but it's true. Unfortunately. And this makes people feel injustice and betrayal even more, even though the real reforms haven't even kicked in yet.