Graph of the week: A slowdown in emerging markets

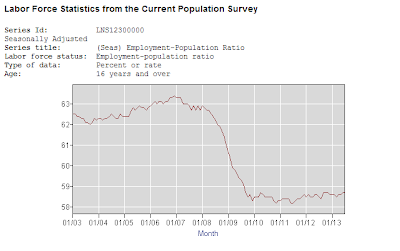

From the WSJ: Source: Wall Street Journal For the first time since the start of the crisis, emerging economies are contributing less to global GDP than the developed ones (see graph below). Just as the developed economies are starting to bounce back, BRICs and Mexico are declining. Exports have plummeted in China, declined in India and Mexico and are slightly recovering in Brazil, while manufacturing is slowing down in all of these economies (graph above). On the other hand developed nations are finally seeing an improvement in manufacturing and exports, which will soon enough be visible in the growth numbers. The stock markets in both sets of nations show this forthcoming trend better than anything. Why is this? Shouldn't the BRICs also feel the recovery of the West and carry on growing just as they did in the pre-crisis decade? Certain things have changed since before the crisis. The most important one was a reverse of the outsourcing trend - the so called "insour...