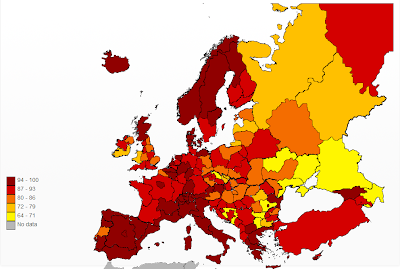

Doing business

The newest Doing Business Report 2014 once again sheds light on where in the world opening and owning a business is a welcomed venture, and where you would be better of not being in the private sector at all. The report is an annual World Bank publication comparing countries in 10 different areas of business regulations such as starting a business, resolving insolvency, getting licences and permits, and even credit availability. It ranks countries based on the ease of starting and handling a business, thereby painting a picture to investors as to which country is more open for investments, i.e. more business friendly. For lower-income countries specific policies aimed at lowering the regulatory burden on businesses will ensure they rise high on the rankings, while for high-income countries, the relative strength of their institutional environment will still keep them on top, despite some of their policies being less business friendly than expected. For example...