Video of the week: Costs of the US government shutdown

Bloomberg has an informative video on the costs of the US government shutdown. Their main point comes down to how much has the uncertainty over political decisions cost the US economy so far since 2009. They come up with with some striking numbers: 900,000 jobs, 0.3% growth p/year, and an 18 basis point increase in the corporate borrowing costs.

The crucial issue everyone is worried about is uncertainty, just as I've predicted in my shutdown coverage. I'm proud to say I got this one right - game theory helped me understand that in the case of the debt ceiling negotiations the commitment device was simply too strong for the parties not to strike a deal. And even though the US default has been avoided, all of this will cost the country dearly (although not as much as it did in August 2011), while uncertainty is looming. The Policy Uncertainty Index has once again escalated, while many analysts are still counting the total losses.

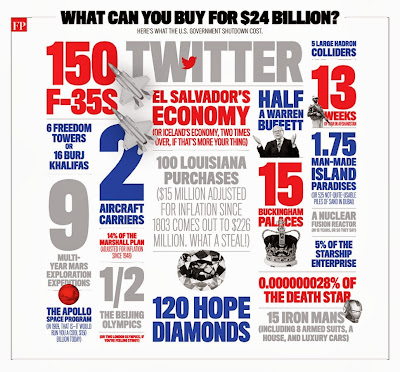

The total cost of the shutdown is estimated to be $26bn, which is nothing compared to a $16 trillion US GDP, but this is likely to downgrade the growth figures (S&P downgraded the growth predictions by 0.6 percentage points). But when we put it in another perspective, here's some of the things we could have bought with this money:

El Salvador's economy looks tempting..Or two Icelands! Come to think of it, just one Buckingham Palace would suffice.

Anyway, with the debt ceiling once more being raised (it will again be reached by February 2014), a frequent question on everyone's minds was "What's the point of having a debt ceiling if all we do is raise it every now and then?" And to this I have no concrete answer. What kind of a signal are the politicians sending to the market about its debt sustainability if every time the debt ceiling is close to being breached, it's raised once again? To make one thing straight, it is expected for the ceiling to be raised as the economy is expanding (GDP is increasing), as long as the debt-to-GDP ratio is sustainable enough (this being a broad definition). But debt-to-GDP is also rising at an unprecedented level, now over 100%. Recall that the main culprits for this over the past decades were (1) the wars in Afghanistan and Iraq during the Bush administration, and (2) massive bank bailouts during the current administration.

So with debt ceilings being raised more frequently in the past few years than ever before, one thing at least is certain - the US will never default on its debt. In a conventional way at least. Meaning investors can relax. On the other hand, if the debt-to-GDP ratio keeps on rising, with political responsibility (and accountability) being dispersed, and no political will to solve the entitlement problem, in the near future things don't look that bright at all.

So with debt ceilings being raised more frequently in the past few years than ever before, one thing at least is certain - the US will never default on its debt. In a conventional way at least. Meaning investors can relax. On the other hand, if the debt-to-GDP ratio keeps on rising, with political responsibility (and accountability) being dispersed, and no political will to solve the entitlement problem, in the near future things don't look that bright at all.

Comments

Post a Comment