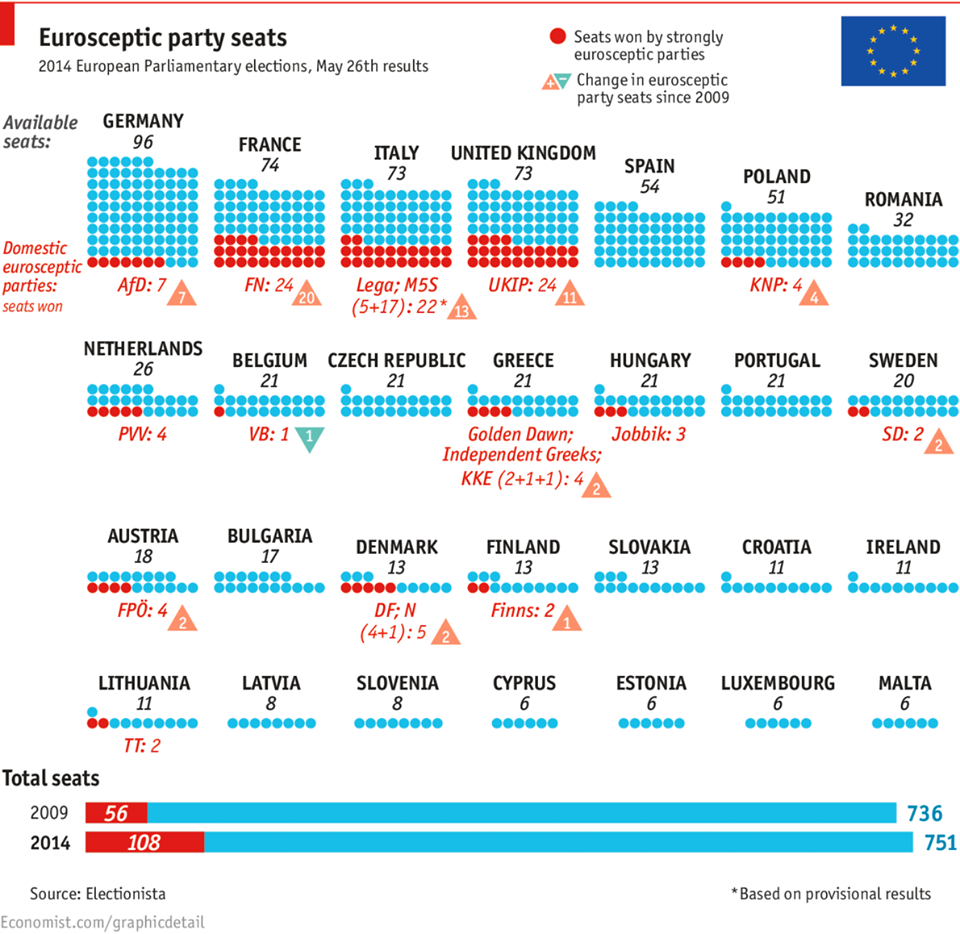

EU elections comment: Marginal parties do well in marginal elections

The success of extremist parties in the latest vote for the EU Parliament shouldn’t come as a surprise, even though it is a slight reason for concern. The agendas and activities of some of these parties such as the French National Front, the Greek Golden Dawn, or the Hungarian Jobbik are just too gruesome to comment. Far from their anti-immigration agendas and their protectionist economic approach, they are examples of the exact sort of thing the foundation of the EU was supposed to avoid – the rise of Nazism. In addition to their almost identical national-socialist pleas, one thing all of the marginal right-wingers have in common is a Eurosceptic agenda, which in most cases calls for the abolition of the EU itself. To stress the absurdity of the situation, imagine that one fifth of the national parliament of a country consists of people who despise the country itself and seek to destabilize it. Their Euroscepticism is the glue holding their interests together and by using it they...