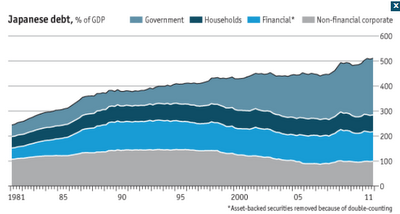

Graph of the week: debt is bad

Relating to my previous post on the dangers of low interest rates, here's the debt time series for Japan:

|

| Source: The Economist, 19th September 2012 |

Looking at the development of Japanese debt since the 90-ies, we can say that it was one interesting ride. Observe the decade long deleveraging done by the private sector and households. On the other hand government debt rose substantially (as % of GDP). What caused the Japanese economy to undergo such a transition and turn itself into the world's largest debt holder? Two decades of low interest rates (among other things). They made it favourable for the government to use debt financing more and more. The result is the graph above depicting an even worse situation for Japan now than it was 20 years ago. I will repeat my point from the previous post: there is a real threat that today's Western economies follow this path and try to deficit-spend themselves to a recovery. This is proven not to work, particularly in the long run (after all we're not even in the short run anymore). As for the short run, today's crisis is much more than an aggregate demand shock.

On the other hand, observe the deleveraging done currently in the US:

|

| Source: The Economist, 19th September 2012 |

This is again another proof that no direct stimuli to the people (like a tax rebate) or the businesses will help them raise their confidence and future expectations so that they can start investing and spending. Check out this previous post to see why.

Here is an overview of the total debt to GDP of the 10 largest economies: http://www.inflation-hedge.blogspot.com/2012/05/why-invest-in-farmland-as-inflation.html Japan is at 512%, but the UK is right there at 507%.

ReplyDeleteYes, that is a big problem for the UK. If you go to the same like where I pulled out the graphs above, you will see the UK as well, where deleveraging hasn't started yet, at least not in the same pace it did in the US.

DeleteThe problem is that so damn many over educated idiots have all thought, and convinced the politicians, that they had a new path to prosperity. And that you can just forget all the basics of economics which you learned in undergraduate classes, or just common sense.

ReplyDeleteBut it turns out there is no substitute for sound money, low debt, low marginal taxes, and sound lending policies. No substitute at all.

The next nation to borrow and spend itself into prosperity will be the first.

I think that there may be an accounting problem in looking at D/GDP ratios, which is caused by financial intermediation and reintermediation. If Japanese households bought JGBs directly from the government, a big chunk of the financial sector's debt would disappear.

ReplyDeletebut Japanese people are major holders of the government's debt. This is exactly why many people seem to think Japan's debt is sustainable, since the government is borrowing from its own citizens, not foreigners.

DeleteBesides, the financial sector debt in Japan isn't the issue, it's the government debt, which has arisen over the years due to having too low interest rates for too long.