Austerity (and inequality) in corrupt countries - a conference with Joe Stiglitz

This week I had an opportunity to attend an international conference "Challenges of Europe: Growth, competitiveness and inequality", where the keynote speakers were none other than 2001 Nobel prize winner Joseph Stiglitz, and Columbia University professor Jan Svejnar.

I went there to present a paper I co-authored with two Croatian economists, Dejan Kovac and Nikola Kleut. The paper is called "How do firms respond to anticipated shocks? Duration analysis of Croatian companies throughout the crisis". The paper is pretty good, but let's be honest, that was clearly not the main reason I went there - the main reason was to get to know people like Stiglitz and Svejnar. Which I can happily say I did.

|

| From left to right: myself, Prof Joseph Stiglitz, and my friend and co-author Dejan Kovac |

The keynote speeches from the two notable economists were both very interesting, but also quite different. Svejnar went first and presented his paper called "Do Billionaires Help or Hurt Economic Growth?", while Stiglitz followed with his more or less standard policy-oriented discussion on "The Euro, the European Crisis and Inequality". I actually found Svejnar's presentation more interesting, which is not surprising primarily because the stuff Stiglitz was saying on Europe isn't new to me, as I've extensively written on the subject myself. Stiglitz made a few excellent points on the Euro's fault for the Eurozone recession, on how Europe was never an optimal currency area which is why the Euro project was doomed from the start, attacking the way the idea of convergence was being executed, implicating external imbalances (CA deficits), and so on - all the things I absolutely agree with (see my in-depth analysis of the Eurozone sovereign debt crisis).

Wealth inequality and economic growth

Svejnar on the other hand caught my attention immediately when he started to present his research paper. He gathered information from Forbes on the world's richest individuals across countries and was trying to test whether they have a positive effect on growth (the right-wing argument) or a negative one (the left-wing argument). The main explanatory variable measuring wealth inequality was the share of billionaire wealth to total GDP, to total physical capital stock, and to total population, measured only for those countries that had billionaires (in $ terms). He found that the overall effect is actually negative, however he decided to decompose the wealth inequality measure into billionaires that were politically unconnected and politically connected to see what drives the total effect. It turns out that it is the politically connected billionaires that are causing the adverse effect on economic growth. See the table below (click to enlarge):

Notice that the significance levels for the politically connected measure of wealth inequality are much higher than for the overall effect (particularly when looking at billionaire wealth to total capital stock - columns (2) and (5) - which I consider to be the best measure of wealth inequality out of the three used). The story is clear; in countries where billionaires made their fortune thanks to political connections allowing them to control and build monopolies, the effect of their accumulated wealth and the consequential inequality on economic growth is extremely negative. In cases where the billionaires weren't politically connected there is no effect between inequality and growth.

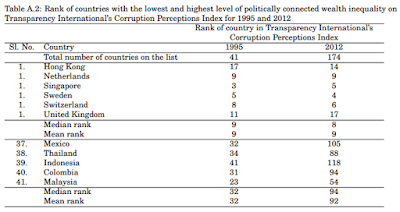

Comparing the top 5 and bottom 5 countries in their ranking of politically connected wealth inequality with respect to their corruption levels, the clustering is quite obvious: the more unequal countries (the higher their billionaires' wealth) are the ones with the highest levels of corruption:

|

| Source: Bagchi, Svejnar (2013) "Does Wealth Inequality Matter for Growth? The Effect of Billionaire Wealth, Income Distribution and Poverty." IZA discussion paper |

Comparing the top 5 and bottom 5 countries in their ranking of politically connected wealth inequality with respect to their corruption levels, the clustering is quite obvious: the more unequal countries (the higher their billionaires' wealth) are the ones with the highest levels of corruption:

|

| Source: Bagchi, Svejnar (2013) "Does Wealth Inequality Matter for Growth? The Effect of Billionaire Wealth, Income Distribution and Poverty." IZA discussion paper |

The full paper is here, co-authored with Sutirtha Bagchi.

The real European problem

This is a very important finding in terms of the whole austerity debate. Going back to Stiglitz and his keynote presentation, what he said on the conference was more or less standard and expected stuff. However, what he said in an interview for the Croatian television the day before was what I found slightly problematic. Stgilitz is a famous critic of austerity policies. And who can blame him when austerity all across Europe was mostly being done from a wrong, tax-based approach. Just look at the average income tax, VAT and corporate tax rates across Europe and how they all increased by a few percentage points during the crisis. Europe became obsessed with cutting the budget deficit, and from a political perspective cutting the deficit is always better to do with tax hikes than with spending cuts - because when you cut spending you're hurting some groups directly, which don't like it and will probably protest (unless you make linear cuts which is always the worse solution with the most negative effect on consumption), but when you raise taxes you virtually create the same effect as with linear spending cuts (a drag on consumption), but people don't seem to be as bothered with tax hikes as with spending cuts. How often do you see people protesting after a tax hike? In terms of electoral chances it's much more dangerous to cut spending to various socio-economic groups (pensions, various benefits, subsidies, public sector wages, etc.), than to raise taxes for all consumers for example.

Anyway, the problem with how austerity was being conducted in Europe is obvious: it had a negative effect on economic growth, as tax rates depressed consumption in times of great deleveraging (people and companies paying off their debts). Naturally the economies were doing bad. Countries like Germany, driven by their own example of unification and the 2003 Hartz reforms, were saying it is necessary to bear the pain during which time countries should engage in reforms. But this never happened. The peripheral Eurozone countries (including Croatia) never really did any reforms during the crisis. And this is the real problem. Not all of these countries are the same, nor should they all engage in the same set of reforms, but they all have one important characteristic: they are all corrupt. Their governments used the favorable pre-crisis economic times (low borrowing costs) to accumulate huge debt levels and to finance various political concessions. Greece, Italy, Spain, Portugal, Cyprus or Croatia - they all had political elites driving their countries to the slump by applying a faulty growth model based on debt, and misusing the convergence mechanism Stiglitz was addressing. Citizens and companies seized the same opportunity; consumer debt levels went sky-high in peripheral Europe. This is why they were all running large current account deficits - imports of consumer goods swamped domestic markets. Living standards were fueled by debt, and it was only a matter of time before this unsustainable system was brought to a halt. The Euro crisis simply brought all the existing domestic instabilities of these countries to the fore. And Stiglitz is right - the Euro is to take a large blame for enabling this type of a growth model.

Austerity and corruption

However the response to this type of growth model in peripheral Europe is hardly more government spending. Classical counter-recessionary measures imply that in crisis times countries should boost government spending in the short run to offset the lack of spending in other sectors of the economy. However this type of policy can to some extent be applied in countries like the US, UK, Germany or Japan (whose borrowing costs will never get affected by too much debt, since the demand for their debt is always high), even though this too is debatable. In countries of peripheral Europe, Croatia in particular, the asymmetry of information and adverse selection are simply too high for these types of policies to work, even in the short run.

Stiglitz made an excellent point that according to the efficient market hypothesis money should always flow to where it's most productive. However because of asymmetric information this doesn't always happen. Conclusion: markets are imperfect. This effect is even more profound when governments push money into the system. When the Croatian government increases public spending to build infrastructure projects, to subsidize public or private sector firms, or to boost investments, there is an immense adverse selection effect. Money flows to politically connected firms and individuals. This is something I prove empirically for Croatia: public procurement is highly subject to corruption, and the higher the corruption in public procurement, the greater the reelection chances of local politicians (up until a certain cut-off level). The interlink between corrupt politicians and quasi-entrepreneurs is just too big, and is creating a substantial drag on domestic growth. The same thing can be observed in Greece, Italy, or Spain. There is no substantial difference. Corruption is systemic. Conclusion: governments are imperfect.

From my experiences abroad, I realize this is difficult to grasp for people living in institutionally stable societies like the United States. To Americans (or any other person living in a country where rules are well-defined) the pinnacle of corruption is the FIFA probe - giving bribes to secure lucrative deals (like becoming the host nation of the World Cup). Corruption in Balkan and Mediterranean countries is much more than that - it is systemic and it is institutionalized. Laws are being changed to legalize criminal acts. Politicians literally have no sense of accountability. Very often they are the heads of organized crime themselves! It sounds impossible to believe, doesn't it? Not according to a multitude of examples from Italy, Greece or Croatia (not to go any further).

Furthermore, systemic nepotism is affecting all spheres of society; under-qualified individuals (often party members) have taken over the public sector, thus driving away the more qualified ones. This is significantly affecting how the private sector conducts business as well. "There is simply no other way, this is how the system works", a discouraged Croatian entrepreneur will always say.

In the last decade more than 150,000 working force Croats left the country. And these are only those registered via the official statistics. Other peripheral economies are facing the same problem. Nepotism is so embedded in peripheral Europe, it's hard for anyone outside to realize this. It is the single most responsible cause of adverse selection on the labor market in these countries. And consequently on government efficiency and the performance of the domestic economy. Here's a good example: someone with an Ivy League degree cannot get a job in Croatia's public sector if they aren't "well connected" (read loyal party members - which Ivy League degree holders are usually not). Anyone who's slightly better than the domestic quacks in any field is immediately a threat the quacks are trying to protect themselves against. It is becoming almost impossible to change and fight this.

In this kind of a systemically corrupt system, the only way to break the connection between quasi-entrepreneurs and politicians is to impose massive spending cuts aimed at breaking up the link between business and politics, followed by long-lasting reforms of the legal system. The problem is much deeper than depressed consumption. This will without doubt cause a huge negative effect on GDP (as the direct and indirect share of government-dependent entities in the economy is roughly 70% of GDP), but it is the only way to break the downward spiral of political connectivity, nepotism and economic depression.

nice post

ReplyDelete