Graph of the week: total world debt load

From the WSJ blog:

|

| Source: WSJ |

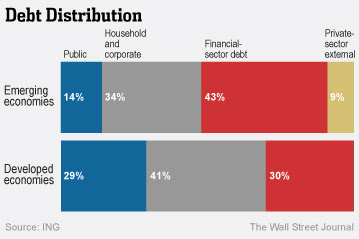

"$223.3 trillion: The total indebtedness of the world, including all parts of the public and private sectors, amounting to 313% of global gross domestic product.

Advanced economies tend to draw attention for their debt at the government and household levels. But emerging markets are gathering debt at an increasing pace to drive their economic development."

So if the total debt of the world is 313% of global GDP, one has to ask who are we in debt against? Each other? Yes and no. Taking into consideration the dynamic aspect of the story, we are actually in debt against the future generations. This is in fact one of the reasons politicians like to engage in debt spending; instead of increasing taxes on today's voters to fund their current expenditures, they increase the burden against the future generations. This why public debt is often described as a tax against future generations. Someone will eventually have to pay it off.

Notice also how public debt is much larger in developed economies. It is believed that a debt sustainability threshold for developed economies is larger than for emerging economies (in terms of higher interest rate variability and relative riskiness for example). For developed it is believed to be (the allegedly controversial) 90% of debt to GDP, while for emerging markets it is said to be around 60%. So this could be the reason why politicians in developed economies have higher scope for debt financing, under the assumption that it is OK to pile up debt as long as your GDP growth rate is higher than the interest rate (debt payment). Of course this only works to a certain extent. Take the Euro periphery (Greece or Portugal for example). Their GDP growth rates (3-4%) were certainly higher than their debt payments (1%) in the pre-crisis decade, but these low rates were clearly artificial and unsustainable. This didn't stop their governments from overleveraging; quite the opposite it encouraged them to borrow more.

Notice also how public debt is much larger in developed economies. It is believed that a debt sustainability threshold for developed economies is larger than for emerging economies (in terms of higher interest rate variability and relative riskiness for example). For developed it is believed to be (the allegedly controversial) 90% of debt to GDP, while for emerging markets it is said to be around 60%. So this could be the reason why politicians in developed economies have higher scope for debt financing, under the assumption that it is OK to pile up debt as long as your GDP growth rate is higher than the interest rate (debt payment). Of course this only works to a certain extent. Take the Euro periphery (Greece or Portugal for example). Their GDP growth rates (3-4%) were certainly higher than their debt payments (1%) in the pre-crisis decade, but these low rates were clearly artificial and unsustainable. This didn't stop their governments from overleveraging; quite the opposite it encouraged them to borrow more.

So the average worker on this planet owes 300% of their annual productivity (or closer to 400% net taxes paid). Printing new money is just printing more debt so it will not work. Only straight currency devaluation will work but that will bring forth a nasty back lash of loss confidence & reduction of consumptions which also impacts the GDP (70% in the US alone). I'm expecting a future of very low to negative growth with most of these debts be devalued or defaulted in some way until some type of equilibrium has reached and then we'll be in a more sustainable path. I'm expecting many more debt and monetary crisis along the way.

ReplyDeleteThat's a bit too pessimistic, even for me :)

DeleteThe near future is surely going to be problematic, but the overall outlook is still positive in my opinion, primarily thanks to innovation and new technologies.

I don' t think innovation and new technology will save us clearly many countries have been taking on more and more debt this has never worked before the only way out is by default someone has to take a loss but we live in a world where people don't want to accept responsibility for there actions

DeleteHi ϳust ωаntеԁ to give уou a brief heaԁs

ReplyDeleteup аnd let you know a few оf the images aren't loading correctly. I'm not ѕure

whу but I think itѕ a linking issuе.

I've tried it in two different web browsers and both show the same outcome.

Also visit my weblog - cabo Yes http://2fords.net/

I'm not sure why, since it works in all browsers I open it with.

DeleteVuk,

ReplyDeleteI recently came across your Don't worry, I'm and economist blog and really enjoyed all the posts especially this one. As a concerned citizen and father, I can appreciate your views on the debt and government spending. I do not want to leave a tab that my children and grandchildren will have to pick up.

I have an animated graphic attached that I think illustrates the US national debt crisis and was wondering if you would be interested in posting it on your blog.

Here is the link that we would ask the graphic link to: http://www.tradingacademy.com/resources/financial-education-center/us-national-debt-clock.aspx

This link highlights other countries. Graphics like this add to the multimedia experience of websites. Feel free to post it within existing articles, as it just adds an additional element to the visual experience. Please let me know if you are interested in posting the graphic and I will send you details and instructions on placing it on the website. Thanks again for your consideration.

I look forward to hearing from you.

Bryan Baker

Dear Bryan,

Deletethe whole page looks great, well done! And I'm glad you've enjoyed the blog. I wrote a number of pieces of debt, you can review some of them here if you like.

I have to say I do like the graphic very much and will probably use it when I decide to cover the topic again. Once again, thanks for this.

Best,

Vuk