Gains from trade: case studies

Trade was covered only briefly on the blog so far (see here and here), but being such an important subject it deserves more attention. Today I draw on three examples, one positive, two negative, all three emphasizing the importance of trade on economic development, wealth etc.

The first example (the positive one) comes from the Economist's Free Exchange blog and the Wall Street Journal on the story behind the Mexican automobile industry.

After going through Tyler Cowen's "Mexico facts of the day" on how Mexico is today the world's fourth largest exporter of cars (after Germany, Japan and South Korea) hoping to surpass South Korea in a few years, and with a strong interest in conquering the Chinese market after already having a big role in the US car market, an article from March this year in the Economist comparing the automobile manufacturing industries of Brazil and Mexico, explains the recent outburst of Mexico's automobile export success:

"By throwing open its market under the North American Free-Trade Agreement (NAFTA) with the United States and Canada and a host of other bilateral trade accords, Mexico has become a base from which carmakers export to both halves of the Americas, and worldwide. Volkswagen, for example, makes all its Beetles and Jettas there. Although Nissan produces some vehicles at a Renault plant in Brazil, most of those it sells in Latin America come from two plants in Mexico. In all, 2.1m of the 2.6m vehicles produced in Mexico last year were exported."

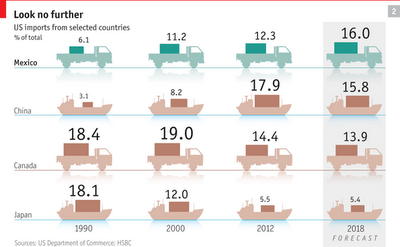

UPDATE (27/11/2012): The Economist has a special report on Mexico this week. It still has a lot of issues to deal with (breaking up monopolies, internet availability, major institutional reforms), but its expanding trade, rising oil production and booming manufacturing are threatening not only countries in Latin America, but China as well (see this great article on its industrial advantages):

|

| Source: The Economist |

In comparison, Brazil is descending into protectionism (I advise you to read the entire article as it describes how two biggest Latin American economies tend to think about trade and industry, through describing their dispute over their 2002 free car trade agreement):

"In contrast, Brazil's government sees the country's domestic market as an asset to be protected. And it sees imports from China, made even cheaper by the strength of the real, as a threat to its industry. “The regional economy has been threatened by predatory competition that has taken hold around the globe,” said Fernando Pimentel, the industry minister, last year. “Developed countries are those that have industry and we're going to protect our own.”

Here once again lies the crucial difference, and the importance of openness as opposed to protectionism:Yet Brazil's growing protectionism risks locking in high costs. The country has “a competitiveness problem, not a trade problem,” says Ricardo Mendes of Prospectiva, a consultancy in São Paulo. Manufacturing's share of GDP has fallen from 17.2% in 2000 to 14.6% in 2011. Falling industrial production was one reason Brazil's economy grew by just 2.7% last year. The blame lies mainly with high interest rates and other domestic burdens."

"Mexico's stance reflects the openness of its economy, at least to trade in goods (many service businesses in the country are in the hands of cosseted cartels). Its average tariff, weighted by the composition of imports, is 5.56%, compared with Brazil's 10.47%, according to the World Trade Organisation. In 2010 almost two-thirds of its imports entered free of duty, compared with just over a quarter in Brazil.

I'd like to add just one point here on the first sentence of the upper quote on how Brazil sees the domestic market as an asset that needs to be protected. Opening your economy and accepting competition from abroad can only amount to raising the efficiency of the domestic economy and lowering the overall costs for the population. This raises wealth of the population since it opens room for new efficient ways of organizing production, creating value, or allocating capital and labour resources.Mexico suffered a big shake-out of its industry when NAFTA came into effect in 1994. A decade ago it saw several hundred thousand jobs in assembly plants go to China. But openness to global competition has made Mexico's surviving industries highly efficient. Industrial production has grown again in the past two years. Manufacturing's share of GDP has remained steady at between 17% and 18% since 2003."

Protecting the domestic market from foreign competition isn't helping it, not even in the short run. It's only making the situation worse by resisting a switch to a more efficient equilibrium and a higher stage of development. The current benefit of emerging economies of Latin America and Asia are its benefits of economies of scale or the new supply chains, but the point of all this is to help the economy reach a higher level of development where economic growth won't be an average 10% any more, but an average of 3%. Manufacturing industries, trade openness etc. will only help a country reach higher wealth faster.

The final example on why trade is important is Gaza (a bit differently than the previous two cases). A paper from Assaf Zimring tells us of the significant negative impacts on declining trade flows during isolation. Here's the abstract: (HT: Tyler Cowen)

"This paper uses detailed household expenditure and firm production data to study the welfare consequences of the blockade imposed on the Gaza Strip between 2007 and 2010. Using the West Bank as a counterfactual, I find that being removed from world markets reduced welfare by 17%-28% on average. Moreover, households with larger preblockade expenditure levels experienced disproportionally larger welfare losses. These effects are substantially larger than the predictions of standard trade models. I show that this large decline in welfare may be due to a combination of resource reallocation and reduced productivity.Using firm level data I find that the blockade triggered reallocation of workers across firms and sectors, especially from manufacturing to services, and from industries that use imported inputs intensively, or export. In addition, labor productivity fell sharply by 24%-29%. This decline was however significantly higher in manufacturing (45%) than in services (5%). These findings suggest that access to world markets did not only determine the location of the Gaza economy on a given Production Possibility Frontier, but also determined the shape of this PPF."

In the last blog post I mentioned Libya and its descent in 2011, followed by a rapid bounce-back in 2012. Another good example of the positive effect of openness on both relative and absolute wealth in an economy.

Mexico is hardly the perfect example. If it were then why is the US filled with illegal Mexican immigrants?

ReplyDeleteMy point is that even if trade and opening boarders can help, it will not result in prosperity..